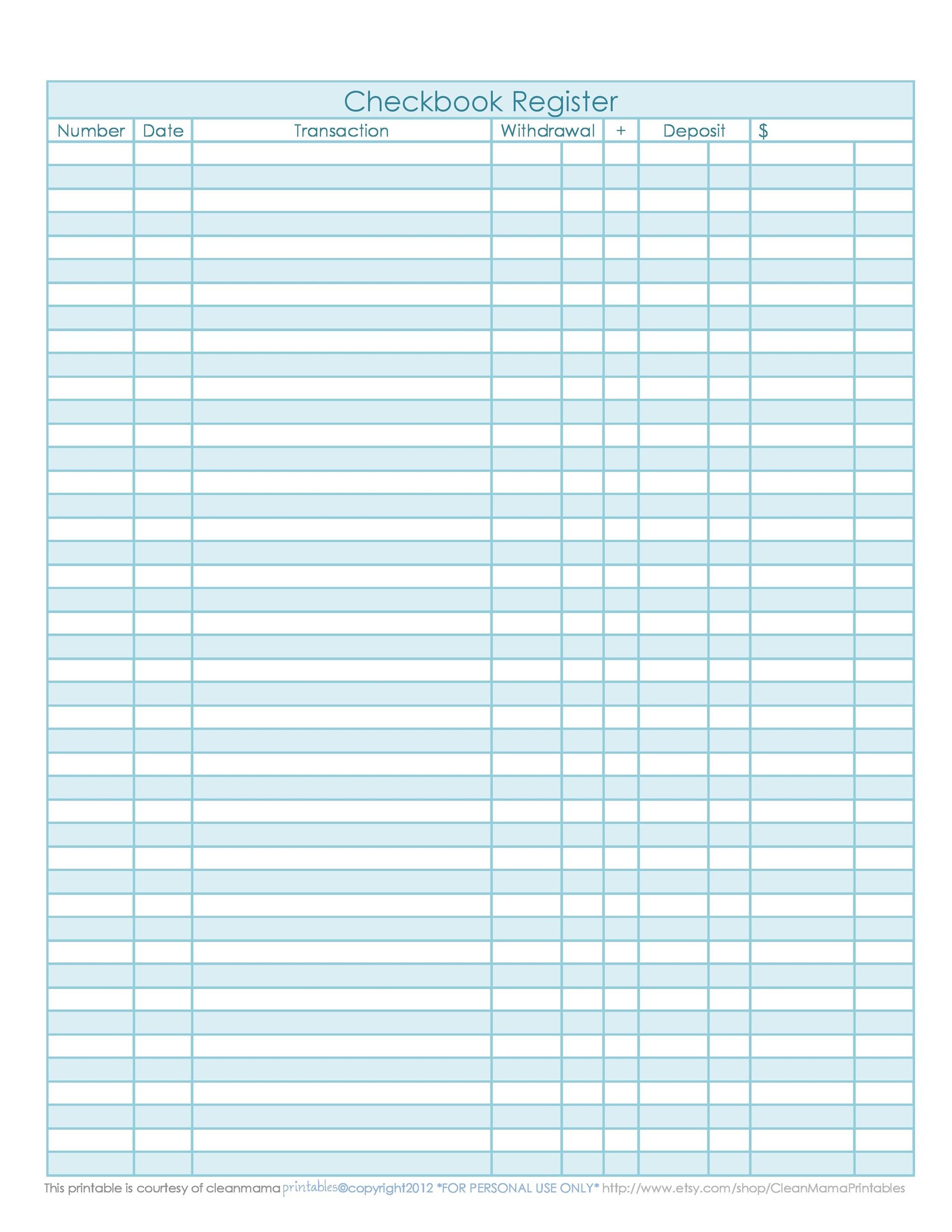

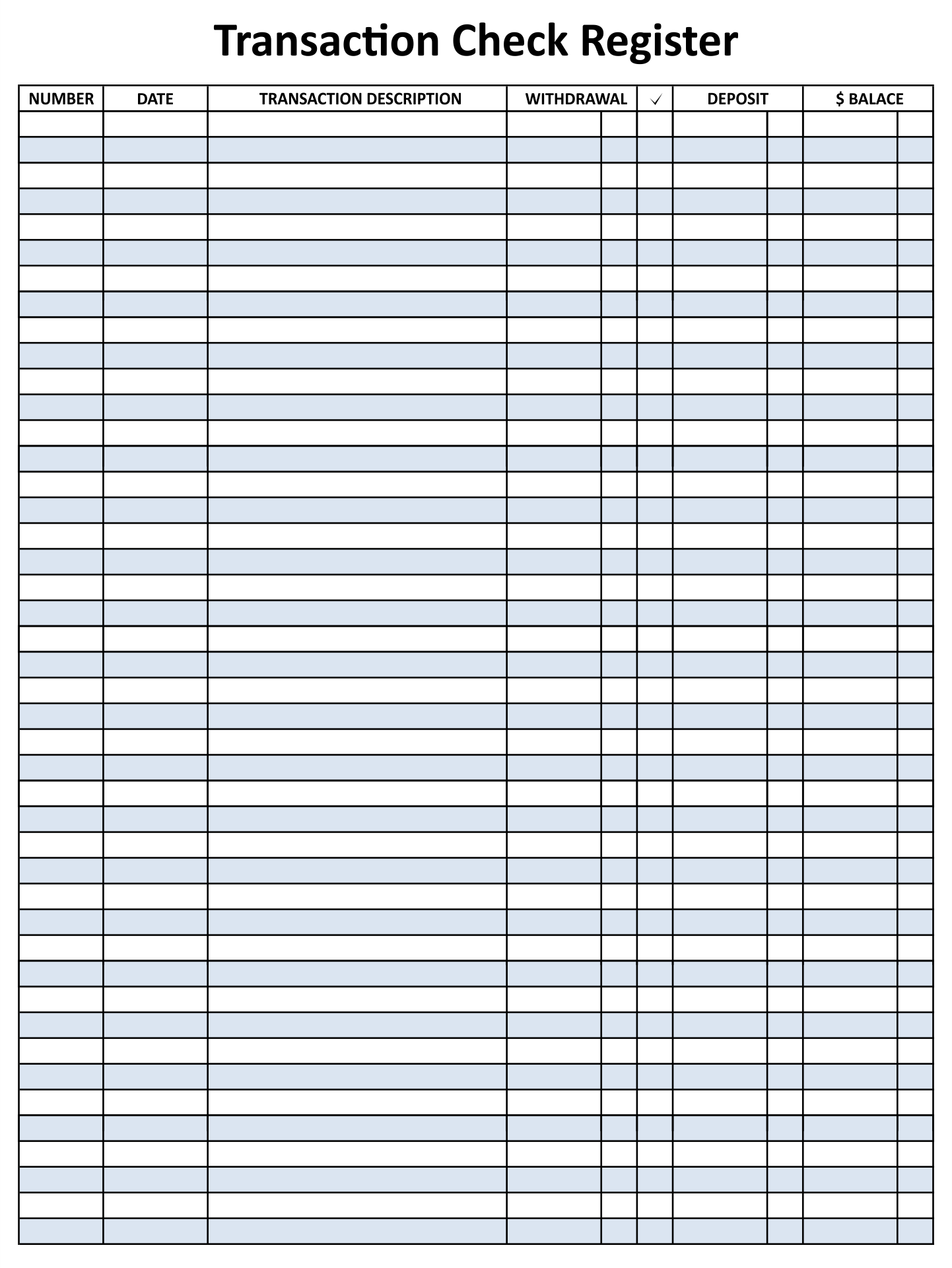

You know how much is left in your savings or checking account as well as the amount that you are allowed to withdraw. Maintaining an updated checkbook register means that you are aware of the current balance in your account. Hence, it is important that you are recording your transactions in your checkbook so you will have something to check and compare to with the bank records. On the other hand, the book balance is adjusted by credit memos, fees and charges by the bank not entered into the checkbook register by the book, as well as errors made by the book in order to arrive at the adjusted balance. You may also check out contact list examples. In this method, the bank balance is adjusted by the deposits in transit, outstanding checks, and errors made by the bank to arrive at the adjusted balance.

However, to arrive at the correct adjusted amount, the adjusted balance reconciliation method is used. You may also like wedding guest list examples. There are many ways on how you can reconcile your book and bank balance, and the commonly used methods are the bank to book reconciliation, book to bank reconciliation, and adjusted balance reconciliation. On the other hand, there are also transactions that are not reflected on the records of the bank. To have a reconciliation on the differences on your book and bank balance, a bank reconciliation is usually performed. You may also see list templates and examples. There are some transactions that you do not have knowledge beforehand because the bank is transacting in your behalf. You must see to it that the end figure of your balances must be equal to each other. One of the biggest reasons that you must balance your checkbook is to match that balance to the bank balance. To match your book balance to the bank balance No matter how huge the amount in your account is, there are still a number of reasons why you should balance your checkbook, and these are as follows: 1. You may also like material list examples. You must be well aware of the movement of your money by constantly updating the records in your checkbook. It is not enough that you rely on the other party recording the transaction it is better to have your own computations in case of issues and disputes. Keeping a record on your checkbook can help you verify the transactions you have made. You may also see printable attendance sheet examples. In today’s era where electronic transactions have been primarily used and preferred by most people because of its convenience, there are still many people who prefer to have their own checkbook register and keep them balanced as as they are doing transactions. Download Reasons to Balance Your Checkbook

0 kommentar(er)

0 kommentar(er)